List of approved projects and agents – Gujarat RERA

Gujarat RERA:

Since the Real Estate (Regulation and Development) Act, 2016 came into force, Gujarat is among the top states in the implementation and adoption of the new reality law. The government of Gujarat established Gujarat Real Estate Regulatory Authority (GUJRERA), vide Notification No. 23 dated 8 March 2017, for regulation and promotion of the real estate sector in the State of Gujarat. It formed the regulatory authority to help homebuyers and register builders, promoters and real estate agents.

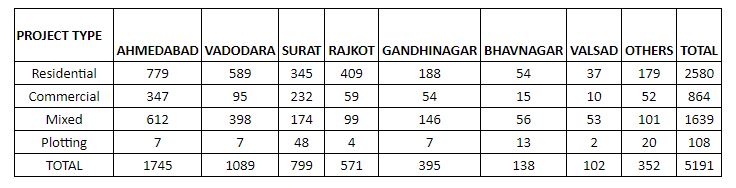

As of now, 3880 real estate projects have successfully registered under Gujarat RERA and the authority has issued 702 registration certificated to its agents. Moreover, the regulatory authority has passed judgment for all the 73 complaints received till date.

List of approved agents for Gujarat RERA: Click here to view

List of approved projects for Gujarat RERA: Click here to view

Irrespective of these proved projects/agents, RERA has rejected several real estate projects as well.

Latest updates on Gujarat RERA

Gujarat realty’s property registration has been increased by 33% because of Affordable Housing.

Disclaimer: the data provided here is based on industry and news reports. CommonFloor will not be held legally responsible for any action taken based on the information provided.