Land Pooling Policy 2020

Land Pooling Policy (LPP)

Delhi Development Authority (DDA) has formulated a Master Plan 2021 for Delhi to improve city planning in the divided zones under the Land Pooling Policy (LPP). Land Pooling Policy is the consolidation of small land parcels to make them into one larger land for construction in order to accommodate the residential and commercial solutions to the people of Delhi NCR. Under the Land Pooling Policy of Master Plan Delhi-2021, the national capital region will begin the smart city plan.

Land Pooling Policy was announced by the urban development ministry in September 2013. The initial phase would see several landowners/developers/societies to pool their land and assign it to the government for developing a percentage of land and retain a percentage to build infrastructure. Delhi Development Authority and the developers would operate in partnership for the development of the LPP Zone.

As per the Master Plan Delhi-2021, 6 Zones amongst a total of 15 zones come under the Land Pooling Policy. These zones are J Zone of South Delhi, K Zone of South West Delhi, and L zone in West Delhi. These zones will attract population and thus the difficulty of housing solutions will be fixed under the LPP.

Land Pooling Policy has encouraged the development of the Indian real estate market and retaining hopes of the builders. Homebuyers can buy luxurious houses at affordable rates in all the prime localities of Delhi NCR. The cautious use of large land parcels will benefit the stakeholders. It’s more beneficial to invest in the LPP approved projects and experience living around robust infrastructure.

Key Amendments:

- Timely development of infrastructure.

- Enabling farmers to pay development charges.

- Mandatory EWS housing units.

- Full utilization of approved floor area ratio (FAR).

- Urbanization of 20,000 hectares of land.

- 95 villages are coming together to develop.

- Provision of 14-16 lakh housing units in Delhi.

- 48-60 percent of the land to be returned back to the owners.

Major benefits of Land Pooling Policy:

- The archaic Land Acquisition Policy has been mastered by the LPP, thus promoting proper land-use and bringing out transparency in land management.

- Better revenue for the landowners and the government.

- Better living at affordable prices.

- PPP Model has been introduced, and it is the first time the government sector is working with private entities to construct quality development in the prescribed zones.

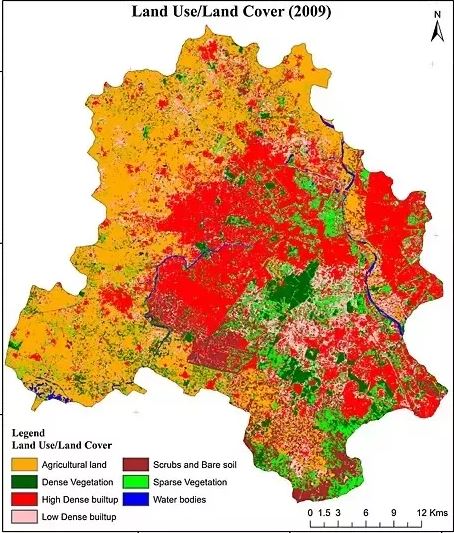

Image Source: Quora

The dark red areas in the above map are the residential centers where the maximum population of Delhi resides. The red spots on the map imply that the residential centers of the city that are fully populated cannot accommodate any more residents on the currently available land. Delhi needs to expand to meet the needs of the migrant population which is expected to be 2.3 crores by 2021. The current infrastructure is only equipped to handle 1.5 crores of the 1.9 crore residents.

Distribution of land returned to DE (60%):

- Gross residential – 53%

- City-level (commercial) – 5%

- City-level (public/ semi-public) -2%

Distribution of land returned to DE (48%):

- Gross residential – 43%

- City-level (commercial) – 3%

- City-level (public/semi-public) – 2%

Which areas will come under the ambit of this policy?

To compensate for the 50-60k acres of land requirement in the upcoming years, areas like Narela, Najafgarh, and Bawana will witness land pooling and development. About 89 of the 95 villages have been listed as urban villages that will accommodate development. This system is a part of the master plan for Delhi-2021 according to which the city of Delhi will be developed.

The master plan has highlighted the following roles in infrastructure development for each:

DDA:

- Time-bound development of Master Plan Roads.

- Create a plan for physical infrastructures such as water supply, sewerage, drainage, provision of social infrastructure, and traffic and transportation infrastructure including metro corridors.

- External development in a time-bound manner (external development charges and other development charges acquired for city infrastructure shall be payable by DE on the actual cost incurred by DDA)

Developer Entity (DE):

- Approval of layout/ detailed plan from DDA

- Demarcation of roads as per layout plan, sector plan, and obtain verification of the same from the concerned authority.

- Develop sector/ internal roads/ infrastructure/ services in its share of land (which includes water, power supply lines, rainwater harvesting, STP/ WTP, etc.)

- Timely completion of development and its maintenance with all facilities (open spaces, roads, and services till the area is handed over to the Municipal Corporation)

Special Provisions for the Economically Weaker Sections (EWS):

As per the master plan, the developer entity will assure sufficient provision of EWS and other housing as per the Shelter Policy of the Plan. Aside from this, the developer entity shall also declare the prescribed built-up spaces, EWS dwelling units, and LIG Housing components to the DDA as per the policy.

- The EWS Housing unit size range within 32- 40 square meters.

- 50% of EWS housing stock to be maintained by DE for regulated sale for community service personnel and the remaining 50% to be sold to DDA, which will be improved as per CPWD index at the time of handing over.

Development Framework and Control Measures

The Government/ DDA will be answerable for creating and implementing a framework for Land Pooling Policy to:

- Frame detailed regulations including process and a timeline for participation in a time-bound manner. The laws shall be put up in public domain for capturing views of all stakeholders by giving a 30-day time frame

- Create a dedicated unit for dealing with approvals of Land Pooling applications

- Create a Single Window Clearance wherein all the agencies accountable for giving time-bound clearances will meet regularly as per notified timelines.

DDA shall formulate the following norms pertaining to the policy:

- The residential Floor Area Ratio (FAR) of 400 for group housing to be applicable on net residential land exclusive of 15 percent FAR reserved for Economically Weaker Section (EWS) housing. Net residential land to be a maximum of 55 percent of gross residential land.

- This is explaining the concept of building higher to support more population

- FAR for city-level commercial and city-level public/semi-public development to be 250.

- Subdivision of residential areas and provision of facilities shall be as per MPD-2021.

How shortly will it be implemented?

Lieutenant Governor Anil Baijal has approved and notified DDA Land Pooling Policy, and the implementation is set to begin once proposals are built on the final draft.

Apart from this, the developers have already started pooling land and we can see housing units soon.

What’s in it for a Delhi resident?

Being a Delhi citizen, you can expect approximately 25 lakh housing units in the coming 10 years. That means cheap and affordable housing.

If you are not a Delhi Resident, you can still invest your money in the land pooling scheme so to be a part of one of the biggest real estate booms in India.