Real Estate expectations from Union Budget 2020

Union Budget 2020 Expectations

The Union Budget 2020 will be presented on 1st February by the Finance Minister, Nirmala Sitharaman. Given the policy reforms undertaken by the government over the past couple of years, the real estate industry is hopeful that the upcoming budget will provide the much-needed impetus. The year 2019 saw the government take numerous steps to help improve market sentiment and revive real estate demand. Reforms such as capital gain benefit, tax exemption on notional rent, incentivizing Affordable Housing, the revised rental income limit for TDS, and thrust on infrastructure growth were highlights of the Union Budget 2019.

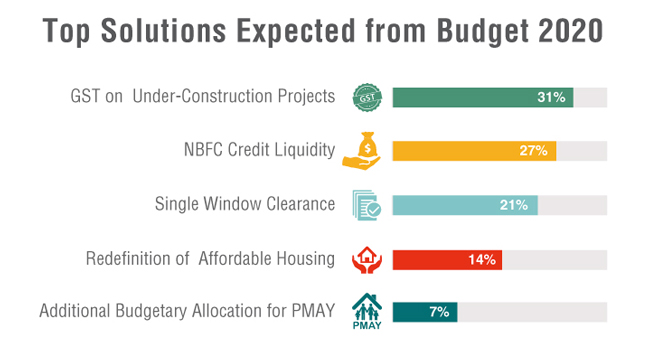

This time around, the sector expects the Budget 2020 to lower the GST rates on under-construction projects, increase the NBFC credit liquidity, implement single-window clearances for project approvals, redefine the Affordable Housing price bracket, allocate additional funds for PMAY scheme, and fuel investment in infrastructure.

In this backdrop, Commonfloor conducted a real estate survey on builders across India to capture their expectations from the Budget 2020. More than 300 builders participated in this survey to express their views and expectations.

The majority of the builders (31%) expect the Budget to lower the GST on under-construction projects. GST reduction clubbed with the revival of Input Tax Credit can provide relief to the builders and housing can be made available at lower prices. After the reduction in GST rates in 2019, the government had withdrawn Input Tax Credit. The next key expectation of real estate is to address the challenge of NBFC (Non-banking Financial Company) liquidity. Liquidity will ensure positive momentum with a steady supply of ready-to-move homes. Also, single-window clearances can aid in procuring quick approvals so that project delays can be avoided. In the past few years, Affordable Housing has been the major growth driver. Still, it needs some reforms as currently only those houses are awarded affordable status and subsequently reduced GST rate of 1% which has a carpet area less than 60 sq.m. and falls under the price cap of Rs 45 lakh (GST rate for under-construction house is 5%)

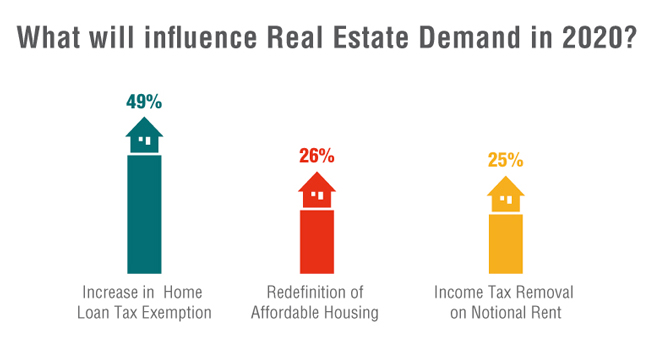

Around 50% of the builders surveyed feel that the increase in Home Loan tax exemption is the primary factor boosting real estate demand. A further extension to the existing 2-lakh tax rebate on home loan interest rates will push the fence-sitters to buy homes. It could result in a higher demand for housing, especially in the affordable and mid-segment categories. Interestingly, “Redefinition of Affordable Housing” and “Income Tax Removal on Notional Rent” got equal responses from the builder community. The abolition of income tax on notional rent from the second self-occupied house benefits those with two houses and encourages home buying.

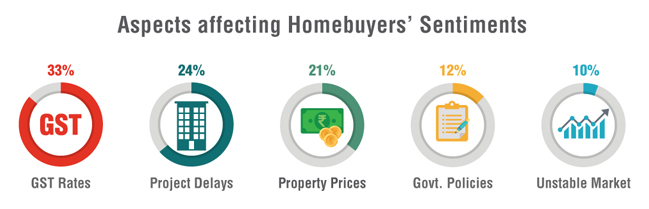

One-third of the builders surveyed feel that the GST rates are the most vital component hurting homebuyers’ sentiment. Apart from GST, project delays and high property prices are the other factors that affect consumer sentiments. Builders feel that the initial aid of Rs 25000 cr last-mile funding for stalled projects is insufficient for the realty sector and that it needs to be executed on a larger level on a priority basis. Moreover, home loan interest rates and high government taxes such as stamp duty and registration could be reduced to propel demand in the market.

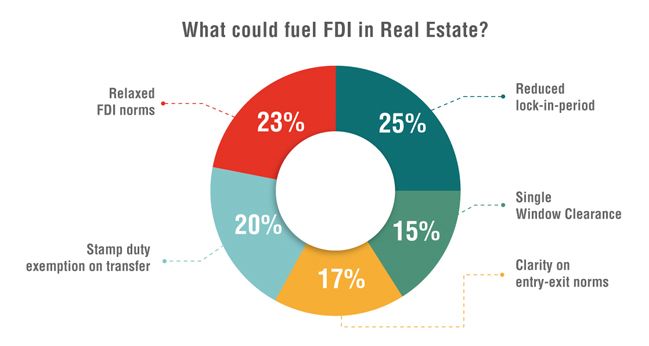

Foreign Direct Investment is a key driver of economic growth and a medium of non-debt finance for any country’s economic development. One-fourth of the builders surveyed responded that single-window clearance will streamline the approval process and can bring about a major boom in FDIs for the realty sector. The next two major factors that can drive FDI are ‘clarity on entry-exit norms’ and ‘stamp duty exemption on FDI transfer’. More FDI in real estate will provide the necessary thrust to the current slump in the market.

Builder Bytes

Ajith Alex George, Director of 42 Estates says, “The real estate category in India requires bold fiscal measures from the union budget. The sector is going through a liquidity crisis with stalled projects across India, an economic booster required for the industry as a whole. Ease of Funding both on the supply and demand side along with quicker processing can again make this one of the key growth sectors. Approvals of projects have gotten better however there could be better clarity on some of the norms and changes in regulations, especially around taxation. Single-window clearance and query handling can make the process easier for the sector.

From the home buyers’ perspective, interest rates on home loans have to be reduced, we have been hearing further reduction on personal tax rates and stamp duties, this can strengthen the buying power of the home buyers which will have a compounding impact on the industry as both residential and commercial projects would get a better demand-side environment. The government is already doing its bit with the PMAY showing good traction, a further increase in subsidy rates for affordable housing can further help percolate this initiative. These steps might give the much-needed boost to the confidence of the developers and buyers alike.”

Conclusion:

The implementation of the above-mentioned measures will help revive real estate growth to a great extent and give a thrust to home buying sentiments, which in turn will revive the economy. To generate cash flows for struggling builders, it is quite evident that the stress fund will be a big boost, but it would address only a small portion of the stalled projects. The rest could only be addressed by NBFCs and banks.

The real estate sector has long needed an industry status that can help to procure finances at a lower cost, especially now, when credit availability is a major headwind. The momentum of infrastructure development should continue from last year so that growth is decentralized and migration to urban centers remain under check. The real estate sector is optimistic that the upcoming budget will usher fresh stimulus in terms of bold fiscal measures to outperform its growth from last year.