Gujarat RERA fined over 300 developers

Under the Real Estate (Regulation and Development) Act, 2016, more than 300 real estate projects across Gujarat have been penalized by the Gujarat Real Estate Regulatory Authority (GujRERA) for missing to file the compulsory quarterly progress reports over the last 9 months. In most cases, the regulatory authority has fined each fraudulent developer Rs.50,000.

The process of submission of Quarterly reports started in June 2018. Since then, various developers have punished for non-compliance, under sections 11 and 63 of RERA Act.

Although the fine for breach of Section 63 of the act can go up to 5% of the project cost, in most cases the fine was fixed at Rs.50000, to assure compliance.

It is given that there are 5219 real estate projects registered with the authority and only 300 or so have been observed to be non-compliant. These numbers indicate that the level of compliance in the state is pretty high.

Most promoters who did not fulfill the quarterly filing measure submitted to the authority that their crime was incidental as the law is new and they were not completely notified of several provisions.

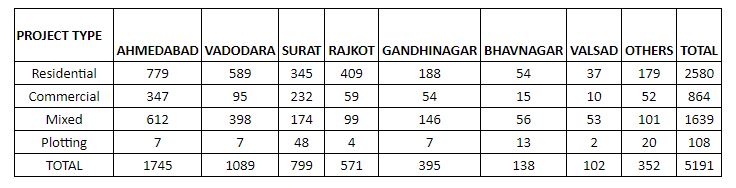

According to the data published on the GujRERA website, the authority has approved around 33% affordable housing projects across the state. The authority has sanctioned around 5200 ongoing residential as well as commercial projects so far.

As of now, 3880 real estate projects have successfully registered under Gujarat RERA and authority has issued 702 registration certificated to its agents.

The data also revealed that as many as 1694 registered projects are Affordable Housing projects. About 878 projects are purely residential, while are mixed use with residential and commercial units.

Ahmedabad has the highest number of affordable projects registered under the Act. Over 500 projects have been registered till date. After Ahmedabad, Vadodara has about 361 affordable RERA Registered projects, Rajkot has 265 such projects, Surat has around 236 projects, and Gandhinagar has over 100 affordable housing projects.

Gujarat Real estate updates:

Around one-third of all the real estate projects registered with GujRERA fall under the affordable housing category.

Promoters & Developers of more than 300 real estate projects across Gujarat have been penalized by GujRERA.

IndoSpace enters Gujarat with Rs 650 cr investment.

Gautam Adani declares Rs 55,000 crore investment in Gujarat in the next 5 years.