Housing societies big or small needs a set of rules and regulations to run smoothly. However, to get it registered they need the by-laws in place. By-laws are nothing but guidelines which are to be followed by the members of the society so as to ensure proper working of the community is ensured. Also, with the help of the by-laws, issues can be addressed in a timely and effective fashion. These are local/private laws and are put in place just after the housing complex is registered. These laws are mandatory and extremely useful as the day-to-day functioning of the complex is monitored and issues sorted in no time with its help.

Crime is increasing each year and it ranges from snatching to burglaries, to murders and much more. The recent one left the residents of the upscale Raheja Arcade miffed. Raheja Arcade is located in Koramangala III Block and mainly houses those who hold mid and senior level positions at top corporates. Raheja Arcade is guarded round the clock but in spite of such high level security (or so it seems) an unidentified gang broke into the compound in the wee hours of Thursday and walked away with a huge sandal wood tree which had grown very close to the main entrance.

Police after the primary investigation says that the gang must have entered with a battery operated saw through the rear end of the building. But what both the police and the residents are still unsure of, is how did the gang even get to know about a sandalwood tree which has grown within the compound, and secondly how can these miscreants enter such a guarded complex.

This is not the first time that such an incident has taken place in Bangalore. The first week of March this year saw Kudremukh Iron Ore Company Ltd. being struck by a similar incident. The only difference being the gang held hostage the security guards and within minutes walked away with the 15 meter tall sandal wood tree. Police say that these incidents cannot take place without the help of insiders – either security guards themselves or people who work as drivers, maids, gardeners and the like in the complexes and hence are regulars, pass on such information.

Have you thought of how to deal with a similar situation if it occurs in your housing complex? But it’s said precaution is better than cure so won’t it be better to safeguard your housing society against such untoward incidents? Well here are some of the things that you can undertake for a safer community living.

- Maintain Visitor Log :- Do make sure that all visitors, vendors and staff are strictly tracked for their entry/ exit through various gates. Their basic detais ( Name/ Number etc) should be tracked while entering the premise. Also make sure they are not fudging their identities.

- Background Verificatiion of Staff :- All staff (full time or part-time) must have background verification done, before being hired. Ideally, any full-time staff should have gone through a round of police verifications through a neighbouring police stations, else you may never know whome you might be employing. If a staff is hired through an agency, insist them to get it done before employing the staff.

- Maintan Staff Database :- It’s important to have a copy of their identity proof (Adhar card, pan card , voter ID card etc.) and a verified mobile number maintained for each Staff( Private of Office) who’s entering the premise on a regular basis. If possible, issue them Badges with their photographs so that it’s easier to identify their movements.

- Managing Resident Guests: - Have a defined process alerting residents when they have a visitor and don’t let anyone in without taking authorization from the resident via Intercom/ phone numbers. If suspicous, have a security guard escort the guest till the residents door.

Do you know of any Smarter way to secure the premises? Feel free to share with us in comments.

P.S :- By the way, do watch out for this space and we might be coming out with a really smart solution to handle this.

CommonFloor Groups is all set to reduce the tedious task of adding payments with our brand new section that will help uploading of payments made by the residents in bulk.

Path: Money Manager> Income > Add New> Bulk Resident Payments

Select the ‘Bulk Resident Payments’ found in the drop down list under the ‘Add New’ section. (see image below)

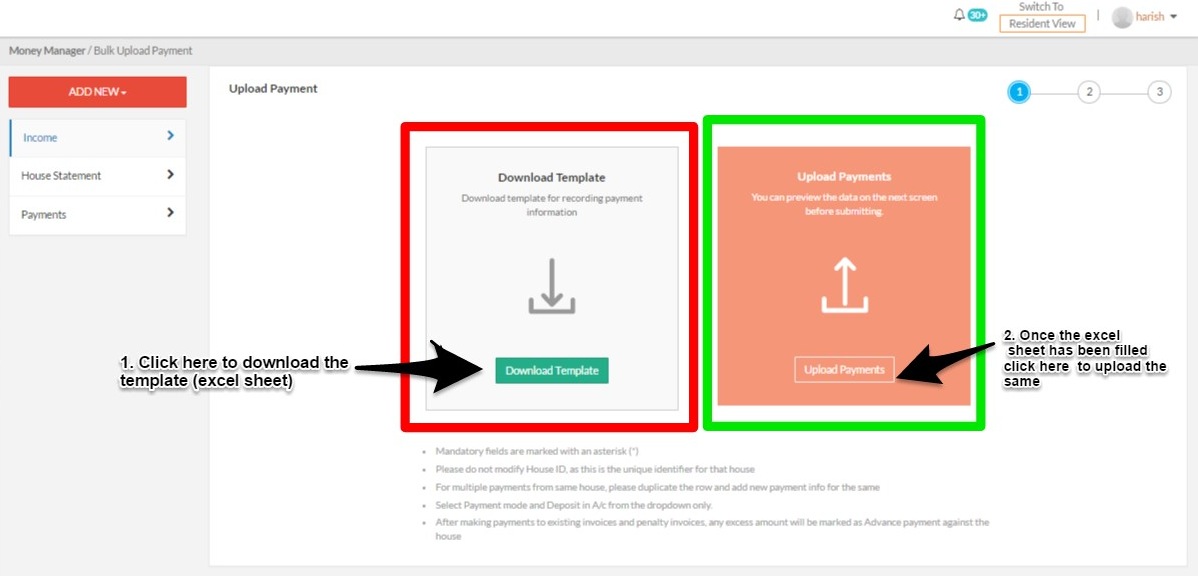

Once you reach the upload payment section you would first need to download the template which is an excel sheet

The excel sheet has 13 columns, which allows to capture all details of Payments received from Residents. Mandatory fields are marked in asterisks (*). After uploading select whether they are for one particular Bulk invoice or for multiple invoices.

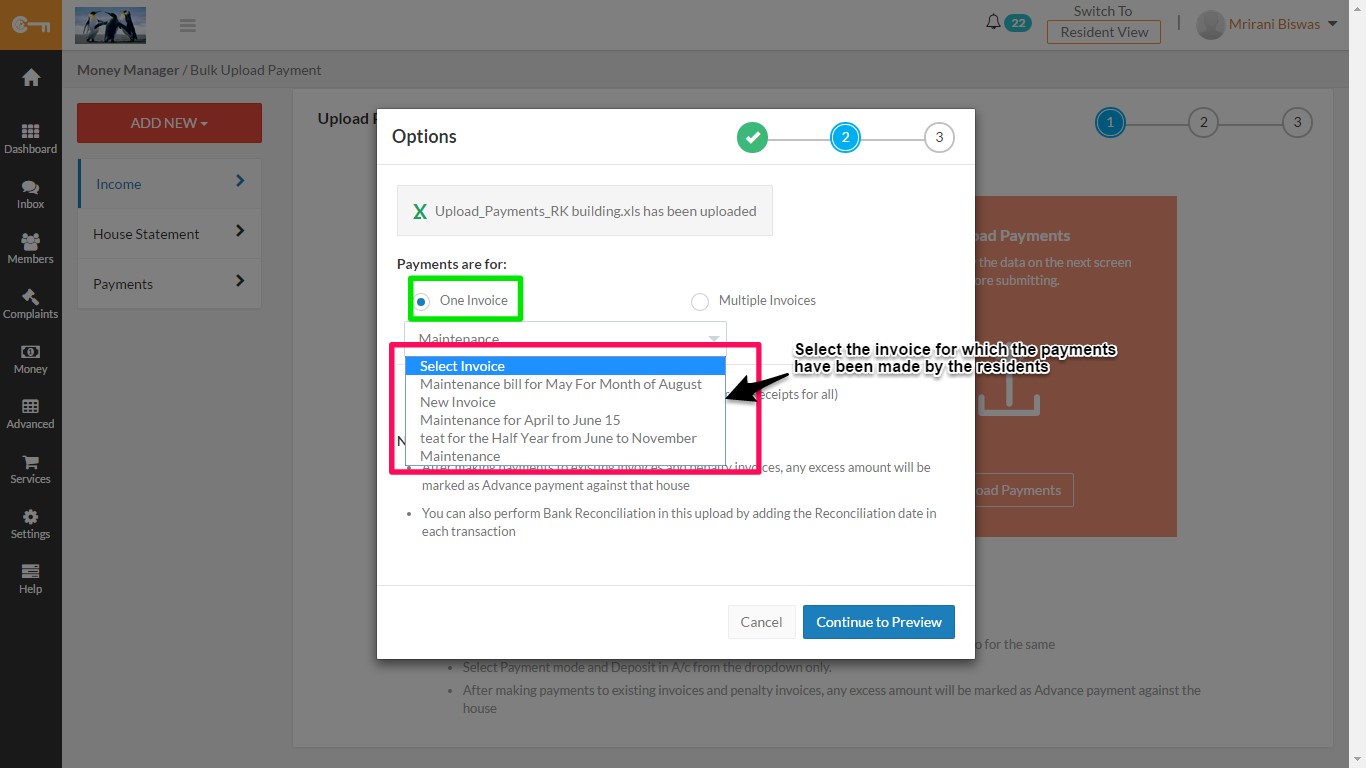

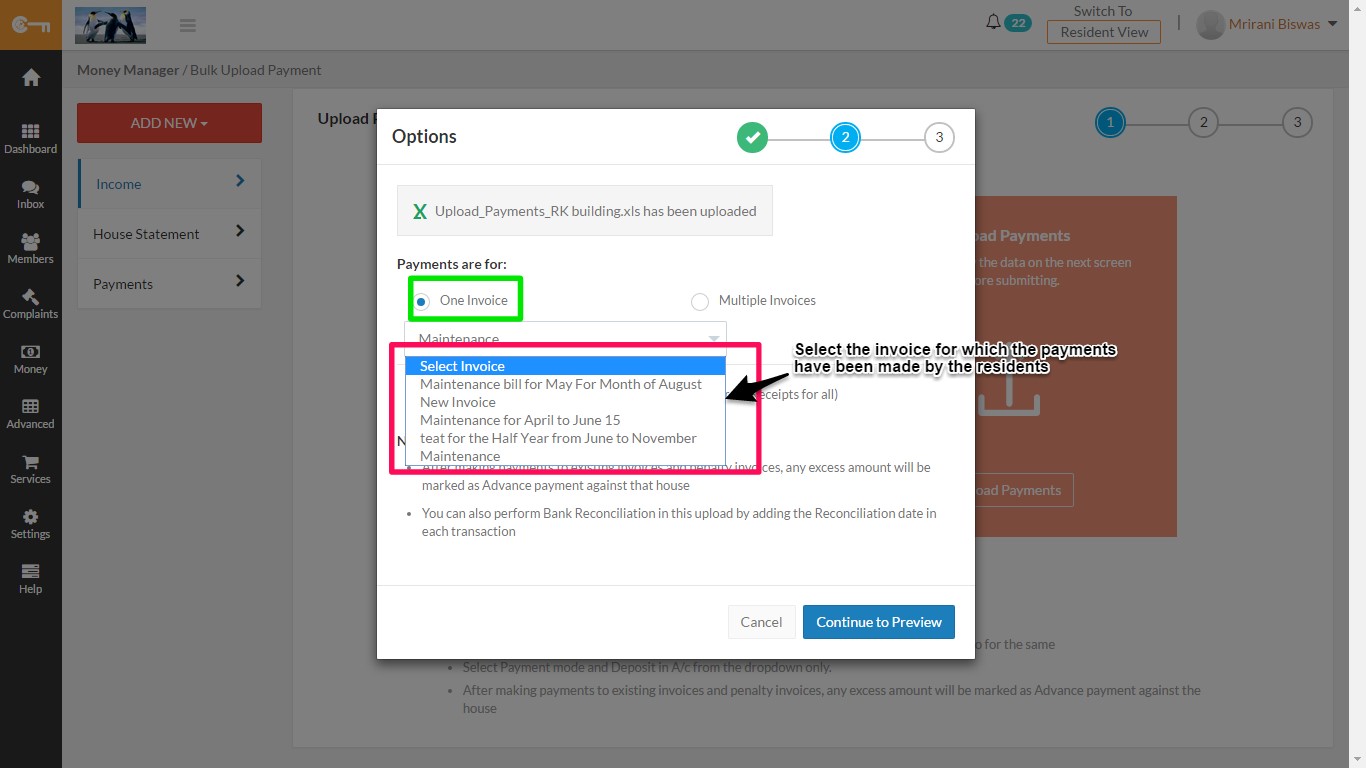

For One Invoice, select the invoice title from the dropdown(see below) and then click on the ‘Continue for Preview’ option. On the next screen, you can preview the data uploaded by you. Verify that these are correct, and then ‘Submit’ which is the third and last step in the flow.

To upload multiple invoices you have the option of selecting either ‘First In First Out’ (FIFO) or ‘Ledger Wise’.

- FIFO is a method which can be out in use for collecting payments of multiple months at one go. Hence, if there are 5 invoices pending against a certain house, then Payments will be marked by sorting these invoices on first-in-first-out basis, according to the Invoice date.

- Ledger-wise payments are nothing but the Ledger-wise priority by which the payments can be taken. If ‘Water charges’ are set as a priority line item, then once payments are received, ‘Water bill’ line items are adjusted first before moving on to other line items in the invoice.

To select Ledger: Settings> Module Settings> Money Manager> Advanced

Do note that if the ‘Auto Approval’ function is not clicked all the updated payments will be pending for approval. Once all updates are made do preview the same before clicking the ‘Submit’ button.

Property Taxes slated to increase with BBMPs proposal to include common area as well for computation

Are you tired of the high property tax, that you have to pay every year? Unfortunately, this will only increase further with BBMP proposing a plan to charge property tax on the common areas in commercial and apartment complexes. Common areas are playgrounds, swimming pools, gardens/lawns, parking spaces etc. All this while, flat owners in a way were paying less tax, says BBMP, as taxes were only being calculated as per the carpet area which is the actual usable area minus the wall thickness. However, since the common areas are used by all on an overall basis, the tax thus paid is comparatively less.

Considering this fact along with BBMP’s need for a higher influx of revenue where they are eyeing a 40% increase, they have planned to charge the common areas used by property owners in their gated communities. Also, club houses and community halls would be taxed separately as communities rent these out for functions and other commercial purposes. In other words these will be treated as any other commercial building and will be taxed in the same manner, the way any supermarket or a mall is charged for property tax.

If you are still wondering about calculations well here’s an example. If you are living in a community with 20 flats, each having a sq ft area of 10,000 for which each flat owner is paying tax individually. Now there are common areas like store room, gym, lawns etc. which all together takes up a sq ft area of 15,000. This 15,000 sq feet area would be proportionately divided among the 20 flat owners.

BBMP is currently only doing the required surveys and has ordered all the tax inspectors and revenue inspectors in each ward to survey the apartment complexes and ascertain the quantum of payments that requires to be made. The survey has already started in Mahadevapura and Bommanahalli zones and will soon reach the other parts of the city. Also, BBMP is studying the tax calculation on common areas made in other metropolitan cities before bringing about this move in a full-fledged way.

However, many apartment owners are not taking this change happily and feels that maintenance already covers the tax on common areas.

Do you think BBMP has made a fair move or is it unnecessary? Do let us know your thoughts on this in the comments section below.

Source:http://www.deccanherald.com/content/483211/tax-likely-apartment-pools-parking.html

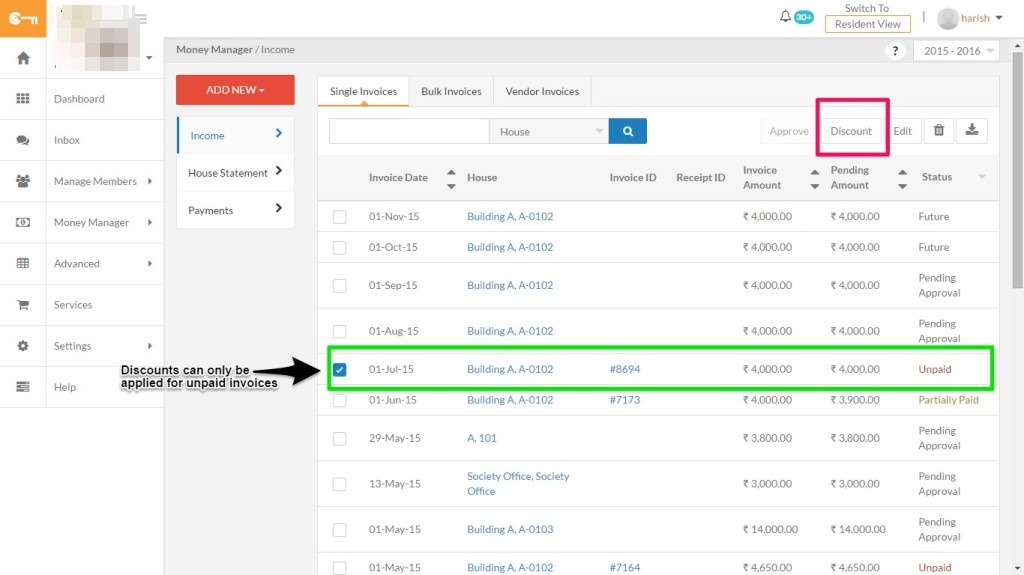

With CommonFloor Groups, Treasurers can easily apply discounts either for single invoices or for bulk invoices. Purpose is to waive off a certain amount of the invoice raised, if required, so that it no longer shows as a Receivable from that house.

Path: Money Manager > Income> Single/ Bulk Invoices

Note: Discounts can only applied for unpaid invoices.

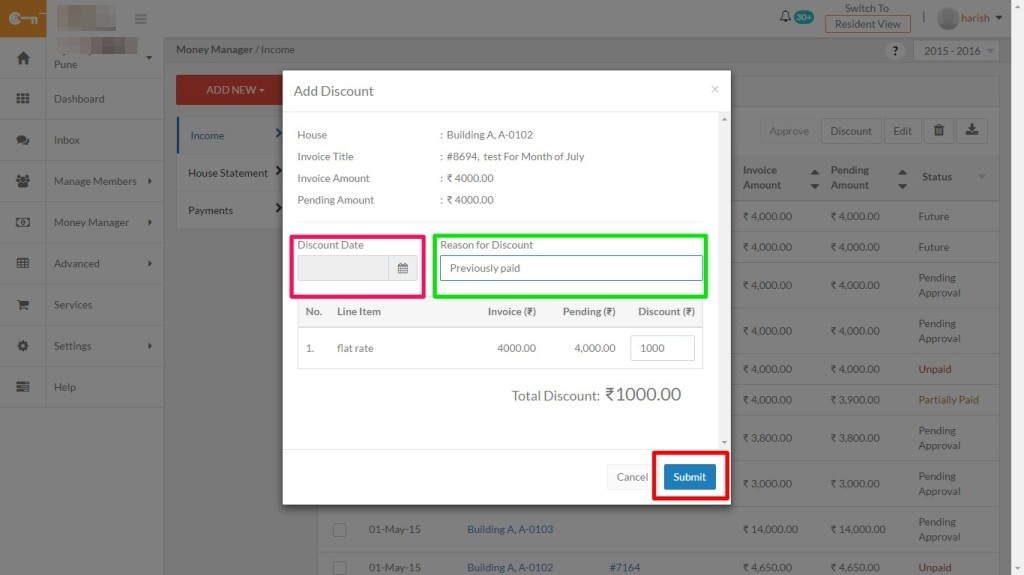

Click on the discount button and you’ll get a pop up box. Enter the discount amount, discount date and the reason for discount. Discounts can only be accessed by level 3 (L3) and level 4 (L4) admins who are the property managers and treasurers.

Once discount is applied the system will consider the invoice as partially paid and you can filter the status of the invoice as discounted and view.

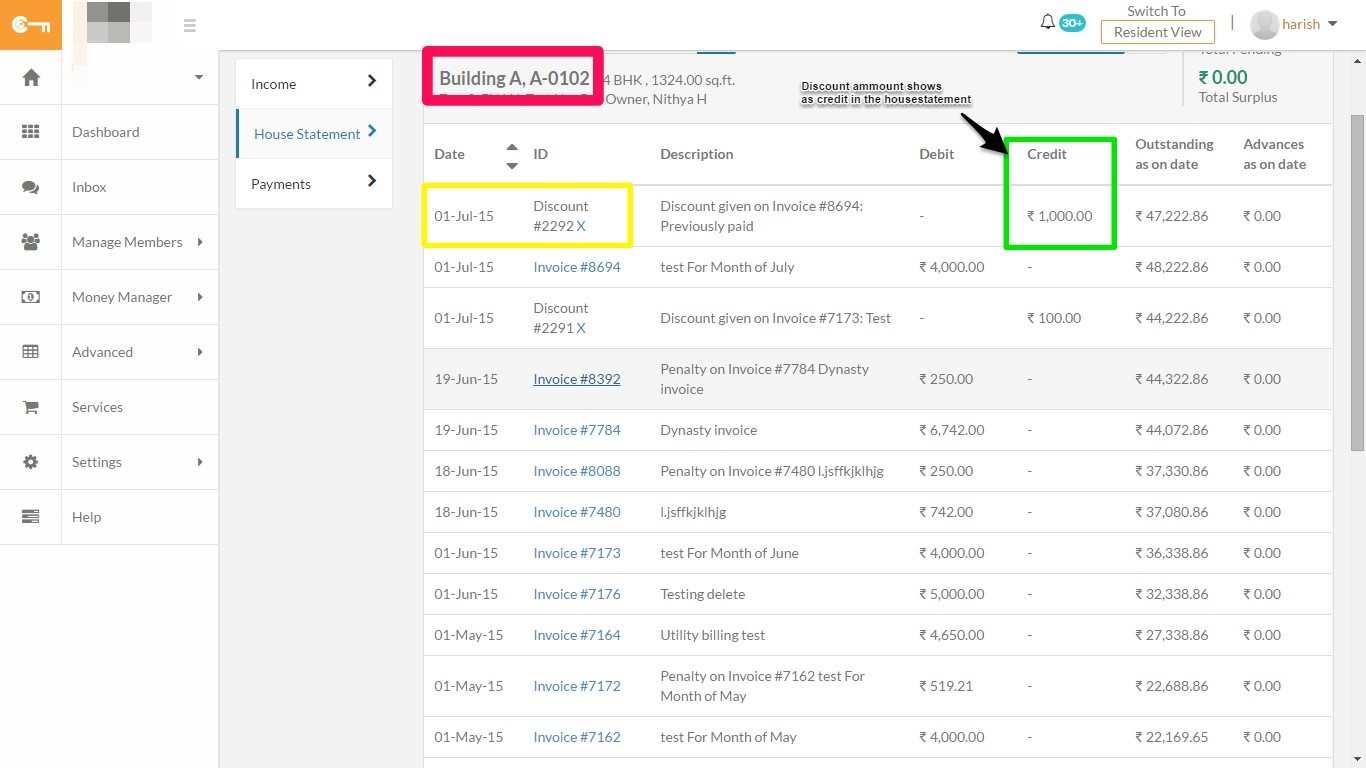

This discount will now show in your ‘house statement’ and also on the ‘transaction report’.

To access the ‘House Statement’ click on Money Manager then Income and you will find ‘House Statement’. Here you can look for the invoice for the month where the discount had been applied against your house number. (In our case it would be July 1st 2015 for house A,A0102). The Discount amount imposed will appear in the Credit of the house statement.

Note: The outstanding amount of that invoice and outstanding amount for the house will decrease with respect to the discount amount.

Money Manager> Income> House Statement

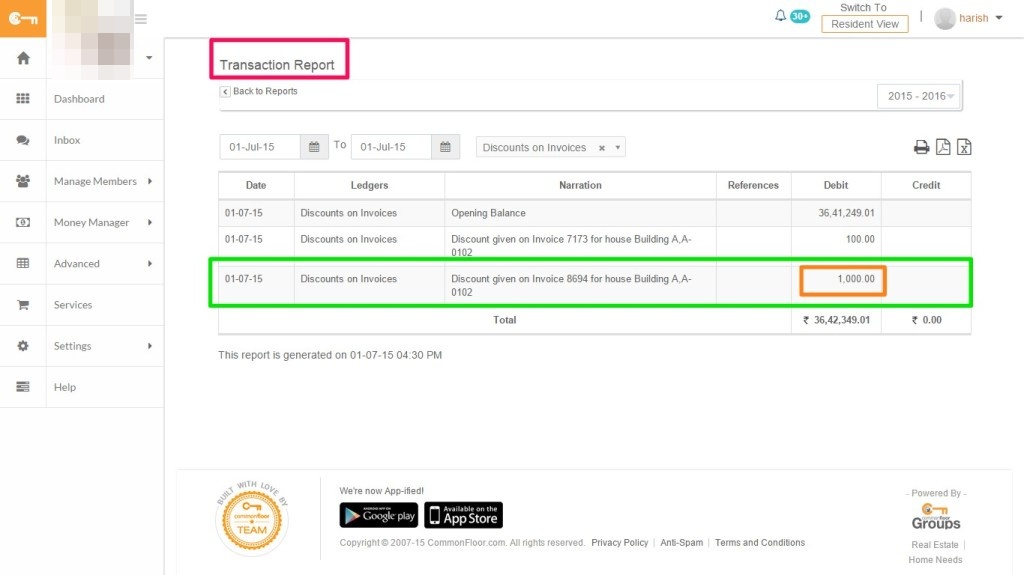

As mentioned above this discount would also show up on the Transaction report. Select the Ledger of ‘Discounts on Invoices’ and here the transaction of Discount is shown as a Debit (this is the other ledger impacted by the discount entry).

Once discounts are applied both SMS/email will be triggered to the resident of the house.

Money Manager>Report> Transaction Reports> Choose Ledger>Discount on Invoices (in this case)

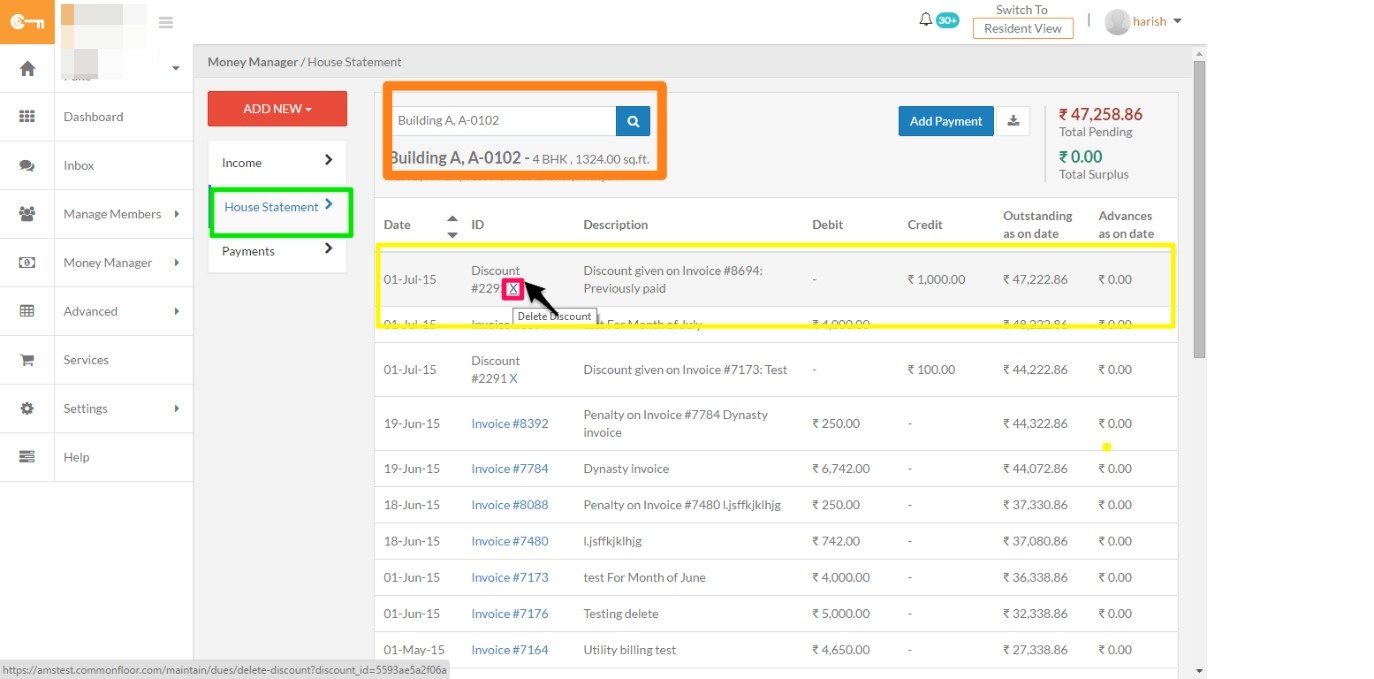

Lastly, to delete enter into the particular house and click the ‘delete’ button. Access it from the ‘House Statement’ option and put in your house number.