Union Budget 2020- Real Estate Highlights

Real Estate Sector Highlights of Union Budget 2020:

Nirmala Sitharaman, Finance Minister of India has announced the Union Budget 2020-21. In the second term of the current government, this is the second budget. Fundamentals of the economy are strong enough to assure the stability of the micro-economic growth of the country. Banks had cleared up and recapitalized the accumulated loans of the past decade. Numerous steps have been taken on the formalization of the Indian economy.

Infrastructure:

Infrastructure was a principal focus for the Finance Minister as she presented her Budget speech. She made various important announcements on infrastructure like setting up 100 new airports for the UDAN scheme by 2024. The presence of an airport will enhance the city’s image as a business destination and will directly augment the scope of rental housing. She also announced that large solar plants would be set up on land owned by the Railways along the railway tracks. 148 km long Bengaluru Suburban transport project at a cost of 18600 crores, would have fares on the metro model. Central Government would provide 20% of equity and facilitate external assistance up to 60% of the project cost.

The government has proposed to provide about 1.70 lakh crore for transport Infrastructure in 2020-21. Proposal has been given to set up a project preparation facility for infrastructure projects.

The National Infrastructure Pipeline was launched on 31st December 2019 of ` 103 lakh crore. It consists of more than 6500 projects across sectors and are classified as per their size and stage of development. These new projects will include housing, safe drinking water, access to clean and affordable energy, healthcare for all, world-class educational institutes, modern railway stations, airports, bus terminals, metro and railway transportation, logistics and warehousing, irrigation projects, etc. The National Infrastructure Pipeline envisions improving the ease of living for each individual citizen in the country. It will also bring in generic and sectoral reforms in the development, operation, and maintenance of these infrastructure projects.

Accelerated development of highways will be undertaken. This will include the development of 2500 Km access control highways, 9000 Km of economic corridors, 2000 Km of coastal and land port roads and 2000 Km of strategic highways. The budget plan had also focused on the completion of the Delhi-Mumbai expressway by 2023 and the construction of the Chennai-Bengaluru Expressway would also be started.

FASTag mechanism encourages us towards greater commercialization of our highways so that NHAI can raise more resources. I propose to monetize at least twelve lots of highway bundles of over 6000 Km before 2024.

Affordable Housing:

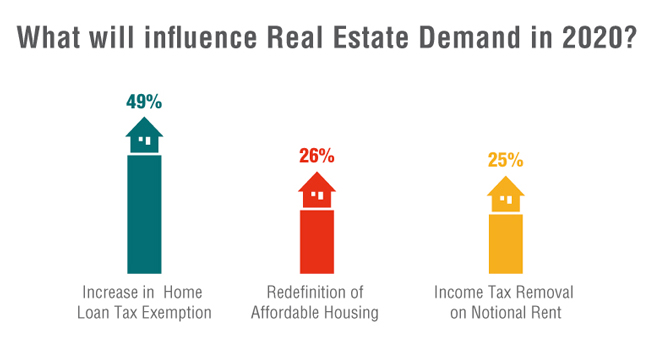

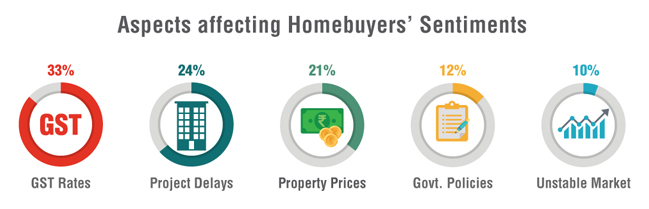

In line with the government’s initiative “Housing for All” and Affordable Housing, it has been announced that the tax holiday is granted on the profits earned by developers on affordable projects approved by 31st March 2020. In order to ensure that more people will avail of this benefit, Sitharaman has proposed to extend the date of loan sanction for availing this additional deduction by one more year. The government also plans to extend the additional reduction of INR 1.5 lakhs for interest paid on home loans taken for the purchase of affordable housing by one year in order to boost the supply of affordable houses in the country. The interest deduction of up to INR 3.5 lakh for affordable housing priced below INR 45 lakh as against INR 2 lakh earlier for loans availed until March 31, 2021.

Personal income tax and changes in income tax slab:

In order to minimize the hardship in real estate transactions and provide relief to the middleclass taxpayers who are willing to let go of certain deductions can now make the switch to new rates. The new and simplified personal tax regime, wherein income tax rates will be significantly reduced for the individual taxpayers who refrain certain exemptions and deductions.

|

Taxable income slab |

Existing rate |

New rate |

|

Rs 0-5 lakh |

No tax |

No tax |

|

Rs 5-7.5 lakh |

20% |

10% |

|

Rs 7.5-10 lakh |

20% |

15% |

|

Rs 10-12.5 lakh |

30% |

20% |

|

Rs 12.5-15 lakh |

30% |

25% |

|

Rs 15 lakh and above |

30% |

30% |

Making Indian real estate “green”:

Eco-friendly or green buildings segments have witnessed a huge growth in the Indian real estate segment. Reports suggest that the Indian green building market alone is poised to increase by 10 billion sq ft. by the year 2022, driven by factors such as increasing awareness level, environmental benefits, and government support.

Concession to real estate transactions and tax rates for co-operatives:

While taxing income from capital gains, business profits and additional sources in favor of transactions in real estate, if the consideration value is more than 5 percent by less than the circle rate then the difference is counted as income both in the hands of the purchaser and seller. In order to reduce hardship in real estate transactions and provide relief to the sector, FM proposed to increase the limit of 5% to 10%. Co-operative societies perform a remarkably significant role in our economy in promoting access to credit, procurement of inputs and marketing of products. These cooperatives are currently taxed at a rate of 30% with surcharge and Cess. FM proposed to present an option to cooperative societies to be taxed at 22% plus 10% surcharge and 4% Cess with no exemption/deductions.

Non-banking financial companies (NBFC’s):

To address the liquidity constraints of the NBFCs/HFCs, post the Union Budget 2019-20, the government formulated a Partial Credit Guarantee Scheme for the NBFCs. To further this support of providing liquidity, a mechanism would be devised. The Government will offer support by guaranteeing securities so floated. The government will allow NBFCs to extend invoice financing to MSMEs. The limit for Non-banking financial companies (NBFCs) under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act 2002 to be eligible for debt recovery is proposed to be decreased from Rs 500 crore to asset size of Rs 100 crore or loan size from subsisting Rs 1 crore to Rs 50 lakh.