Why one should buy an under-construction flat over ready-to-move-in Bangalore?

Buying property is an important decision for all. It’s an emotional decision which can be taken very cautiously. You are not going to switch your home in the next few years after buying, rather you will not sell it off except you get a better deal or need a bigger home.

The resale housing market, especially the new, ready-to-move-in section, gives home-buyers a chance to avoid the risks of buying under-construction properties that are likely to extreme delays.

Ready-to-move-in properties reduce the chances of getting cheated, apart from offering other benefits.

Ready-To-Move-In flats are more expensive than an under-construction flat in the same locality. You should have a strong financial position for a ready-to-move-in flat, as you would have to pay the full cost of the property before the builder handovers you the keys. Your home loan should be sanctioned, and EMIs on the full loan amount will start instantly. On the other hand, an under-construction flat has an easier payment method, as you would have to make staggered payments spread over the years.

This is, perhaps, the only positive for an under-construction flat, however. “The price gap between RTM and under-construction apartments has narrowed considerably because of the supply overhang

If you are planning to buy a property, you would get lots of options. But there is an advantage in choosing a ready-to-move-in property. Below we are listing a few of its advantages and disadvantages:

Advantages of Ready to Move in Property:

- Immediate Authority on Your Flat Purchase: In case of ready-to-move-in property, you can instantly move into your new house. You will immediately get the possession of your home, what you have paid for whereas for an under-construction property you have to wait for 3-5 years for the flat to be delivered.

- Low-Risk Involvement: In a ready-to-move-in property there are no risks of delay possession. While in the case of under-construction property, project delays are much more common and there are many cases where a builder has duped buyers. So, you need to be cautious while choosing a builder for an under-construction property.

- Instant Relief from Paying Rent: Once you relocate into your new home, you won’t have to pay any rent. All you have to pay is EMI for your home loan. While in an under-construction property, you will have to carry both EMI and Rent for a number of years.

- You will get what you will see: An under-construction property is sold on papers. Sometimes, there can be some discrepancies in the final outcome and what you were promised. On the other hand, in the case of ready-to-move-in property, you will first see and inspect the product and then only you will decide to buy it or not.

- Immediate Tax Benefits: In a ready-to-move-in property you can challenge tax exemption on your home loan on both principal and interest repayment instantly while tax benefits on home loan for an under-construction property can be claimed only after you get the flat possession.

- Only EMI With No Down Payment: The most helpful thing about ready-to-move-in property is that you will have to pay EMIs on the home loan, and would include no other payments. In case of an under-construction property, EMI normally begins after completion of construction work. Despite this, if there is any delay in the construction, then the EMI will start once the home loan gets dispensed.

- Check The Infrastructure And Other Facilities: When you are buying a ready-to-move-in property, you can check the infrastructure and other facilities around the flat before buying the property.

- No increased cost: This is another advantage of buying a ready-to-move-in property as you are not supposed to pay the increased cost of the property after paying the booking amount. But in the case of under-construction properties, you have to bear the increased cost of the property.

- Buy within Your Budget: In a ready-to-move-in property, you can select a property within your budget. If you have a lower budget, you can buy a home that fits into your budget. Whereas, when you buy an under-construction property if the project got delayed for three or more years the builder asked for increasing the cost of construction which you have to bear and it increases your overall budget.

- No GST: Taxes play a crucial role in buying a property. Currently, a buyer does not pay any GST while buying a ready-to-move-in property. An under-construction flat, on the other hand, attract 12% GST. So, if you buy an under-construction flat worth Rs 60 lakh, you will have to pay Rs 720,000 as GST.

- Rental income: If the flat you’ve bought as an investment and not for personal use or, if you are planning to move in later, you can rent it out and make some rental income. You can use the rental income to pay your EMIs or keep it as a rental income.

- Ease of selling: It is difficult to sell an under-construction property, especially if its possession is delayed or it’s involved in litigation. In many cases, developers do not allow the transfer of apartments until the project is complete.

Disadvantages of buying a ready-to-move-in property:

- High Property Cost: One of the major drawbacks of buying a ready-to-move-in property is the higher cost as compared to an under-construction property. The cost difference could be anywhere between 20-30%.

- Construction Quality: It is very easy for an under-construction property to analyze the work progress and thus being aware of the quality of construction in terms of the material used, the strength of the foundations etc. But you can not conduct any such inspection in a completed flat.

- Age of The Property: Buying a ready-to-move-in property might not always ensure you a brand new home like an under-construction property. The flat which you have bought might be up for sale for a long time. Therefore, if it has not been maintained properly, it might look old.

- Exclusion from RERA: An old ready-to-move-in flats with Occupancy Certificate as on 1st May’ 2016 have not been included under RERA. Thus, its promoters are not accountable to make its information available on a public platform.

- The under-construction projects are no less in terms of quality and cost if you do all your due diligence on the project such as price, location, developer, and other related aspects. The under-construction projects offer a higher return than a ready-to-move-in-property.

Advantages of buying an under-construction property:

- Cost-effective: The cost of a property for the buyer is one of the most important things. An under-construction property is likely to cost less than ready-to-move-in properties. Buyer will get many options of under-construction properties. It is also true that possession gets delay but cost worth. With RERA in place, developers must deliver on time and if they don’t they are responsible for compensation to buyers. Post RERA, there is an added advantage of booking a unit in an under-construction for the buyers.

- Good Appreciation on Investment: Since you are buying your property at a lower cost, the appreciation is expected to be higher. As the construction work in progress, the cost of your property also increases. For good returns on their investment, one should check the location, upcoming infrastructure and employment hubs situated nearby.

- Payment Flexibility: While buying a ready-to-move-in property, a buyer has to pay the entire amount one chance. There are stamp duty, registration charges and other miscellaneous expenses as well. But at the initial stage for an under-construction property, you are paying 10-15% as a booking amount for under-construction properties. You pay EMIs to the bank in case the property is financed or else you pay as per the construction plan.

- Discount and offers: It is very difficult to get a discount on a ready-to-move-in property. It is a complete house and you need to pay the cost as per the market and even more depending on the amenities. However, if you are buying in an under-construction project, there are several discounts and freebies offer such as gold coin, modular kitchen, air conditioner, gold coin, free car parking among others. You can also negotiate on the final price.

Disadvantages of buying under-construction property:

- Under-construction properties are usually in the under-developed parts of the city and therefore, the capability for price appreciation due to future development is always good. However, this is not true in each and every case. Earlier, buyers have stuck in lots of litigation cases after buying under-construction properties. Before buying an under-construction property, one must have to look at the location and coming plans around that area. Apart from that, in an under-construction project, a buyer also has flexibility in payments, with options like construction-linked plans, subvention schemes, flexible payment plans, etc. Below is the list of disadvantages for an under-construction property:

- Delay Possession: This is one of the most common issues related to under-construction projects. In most cases, the project got delayed due to various reasons and in this situation, the buyers face the consequences. Generally, the builders projected a maximum of 3 years timeline to complete the project. But in maximum cases, the project got delayed for more than 3-5 years.

- The increase in property costs: This is another common problem faced by the people who book an under-construction property. If the project got delayed for even 2-3 years, the builder asks for the increased cost for the property. It is a kind of burden on you as you were expecting a certain amount to be paid once you got the possession of the property, but because of the delay in the construction, you have to bear the increased cost of the property.

- Compromise with quality: When the builder shows you the sample flat, it is usually built with all possible facilities and with the best quality products. With time, you make an expectation of getting the same quality of work done within your home, but when you get the real home you find that it is much different from the promised one as the builders don’t use good material in construction. This type of situation arises very rarely and with unprofessional developers. After the implementation of RERA, a builder cannot change the building approval plan once sanctioned and display the same on their website.

- False projection & promises: This is one of the most common and biggest issues with under-construction properties. The builders make numbers of promised to the customers related to infrastructure and amenities within the society, but in most cases, you don’t receive what you have been promised. But after implementation of RERA, the builder has to offer what he has promised during the agreement. A builder cannot change the building approval plan once sanctioned and display the same on their website.

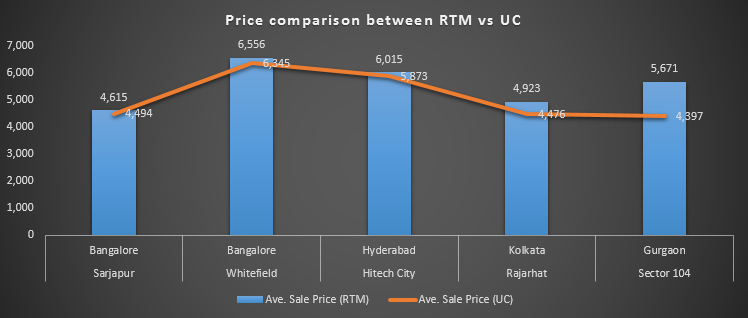

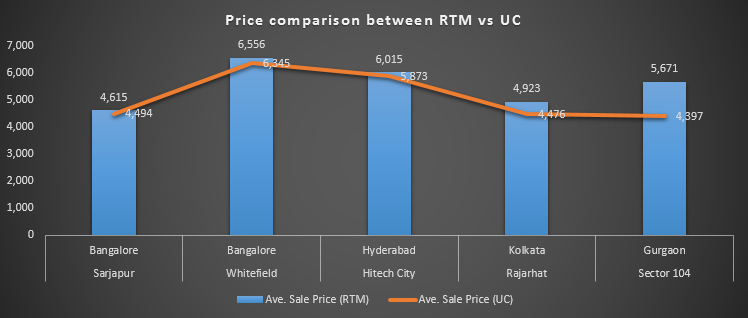

What does CommonFloor data say?

As per CommonFloor research and analysis, we have selected four top real estate destination of India and found that Under-construction property rates are cheaper than ready-to-move-in. Why? Our builder is busy constructing the apartment and the locality around this apartment also develops with time. A few years later your apartment is ready and you take possession of it in a posh locality. Under-construction flats give you bargaining power. You can negotiate with the builder for a cheap flat. Here is the list of top 4 localities and its rate as per BSP:

|

Locality

|

City

|

Avg Sale Price (RTM)

|

Avg Sale Price (UC)

|

|

Sarjapur

|

Bangalore

|

4,615

|

4,494

|

|

Whitefield

|

Bangalore

|

6,556

|

6,345

|

|

Hi-Tech City

|

Hyderabad

|

6,015

|

5,873

|

|

Rajarhat

|

Kolkata

|

4,923

|

4,476

|

|

Sector 104

|

Gurgaon

|

5,671

|

4,397

|

Price analysis between Ready-to-move-in Vs Under-construction:

From the above data, we found that the rate of an under-construction property is much cheaper than a ready-to-move-in property.

While buying a ready-to-move-in property, a buyer has to pay the entire amount one chance. There are stamp duty, registration charges and other miscellaneous expenses as well. But at the initial stage for an under-construction property, you are paying 10-15% as a booking amount for under-construction properties. You pay EMIs to the bank in case the property is financed or else you pay as per the construction plan. There is flexibility in terms of payment and you do not need to arrange a huge amount to buy an under-construction property.

The interest burden on loan:

In an under-construction property, a bank dispenses the loan amount partly to the builder. However, you may be required to pay the EMI on the approved loan amount and not the disbursed loan amount.

EMI for under-construction property permits you to make payments through EMIs, in a partially dispensed loan for an under-construction project. The loan amount is partially dispensed and EMI is fixed as per the approved amount. The period of the loan continues moving up with an extra amount being dispensed. The EMI will continue constantly during the tenure of the loan. Save on interest and secure faster payment of the loan. As your EMI starts instantly after the 1st disbursement, your principal repayment also starts together, by that reducing your interest burden and tenure.

|

Month

|

Stage

|

Amount Disbursed

|

Pre-EMI

|

|

1st Jan

|

On agreement

|

Rs 10 L (20%)

|

Rs 8,750

|

|

1st July

|

On completion of foundation and ground floor

|

Rs 10 L (20%)

|

Rs 17,500

|

|

1st October

|

On completion of 1st and 2nd floor

|

Rs 10 L (20%)

|

Rs 26250

|

|

31st December

|

On completion of 3rd floor and possession

|

Rs 10 L (20%)

|

Rs.39935

|

As explained above, you would pay (8750 x 6) + (17500 x 3) + (26250 x 3) = Rs 2,36,250 as pre-EMI (interest) towards the dispensed loan amount. Your EMI of Rs 39,935 for the leftover 20 years starts from 01-Feb (i.e., a month after final disbursal).

Here are the tax benefits that you can avail when you take a home loan for an under-construction property:

1) As under-construction properties are relatively cheaper, the capitals required for them would be relatively low. Therefore, the EMI payable on the loan amount would also be lesser.

2) As the EMI on the loan is pretty fair, you can increase your monthly instalments to decrease the loan period. This will encourage you to save more on your total interest payment.

3) The person who is taking the home loan can refuse the deduction of the interest amount paid during the pre-construction phase.

4) One can get tax benefits for the stamp duty and registration fee on the property.

5) The interest amount paid earlier to the year of completion is collected and 1/5th of this amount is released as a deduction each year for 5 years from the year of completion. Simply, the interest paid on the home loan during the pre-construction phase can be taken for deduction in these 5 equal instalments.

Recommendation & Suggestion:

You must buy under-construction flats only from builders who have approved from state RERA with a good reputation and established projects. After the implementation of RERA, a builder is responsible to deliver the project on the mentioned time and if they don’t, they are liable to pay compensation to the buyers.

Since you are buying an under-construction property at a lower rate, the appreciation is expected to be higher. As construction progresses, the price of your property also increases.

If you’re planning for under-construction property, estimate your financial position, documents required to purchase and about the developers. It is essential to know your neighbourhood and the available infrastructure around the area such as nearby markets, common public areas and parks, connectivity issues, among others.

If the developer is appreciated, then banks will definitely request you to get yourself a loan. Buying a home can be a risky business, but buying after a good research and thinking about the long term return will be profitable.