Is Indian Real Estate Sector Going to Revive in 2020?

Real Estate Sector in India

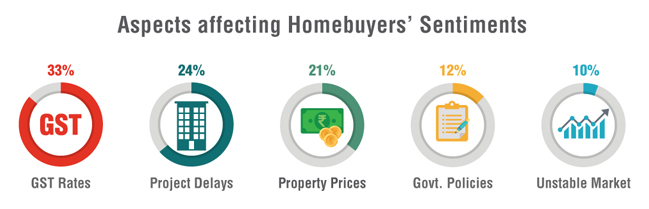

The real estate sector in India has been witnessing weak sales for the last few years, resulting in a sharp drop in its significant contribution to the country’s Gross Domestic Product (GDP). Overall, the year 2019 proved to be a mixed year for the nation’s realty sector as the commercial sector flourished but that was not the case with residential real estate. However, some positivity has been seen in the market as a result of various announcements made by the government last year. Government announcements like NHB raising liquidity for Housing Finance Companies, relaxation of External Commercial Borrowings (ECB) funds, and approval of a Rs 25,000-crore alternate fund have all been made at a positive pace.

Nation’s real estate sector saw a fall after banks limited lending activity post the NBFC crisis in 2018 and the situation worsened further in 2019 to a sharp demand crisis. Not just the real estate sector but a large number of other industries indirectly related to the sector have also suffered the heavy winds of low demand.

Real estate developers, consumers, and investors have been facing the burden of the fall in the housing segment for the last few years. From unsold inventories to incomplete construction to delayed projects, the segments had faced a lot of difficulties that have been pointing to negative sentiments.

In spite of the government’s measures to revive the weak realty market, there has been no positive result except limited growth of just 1% in the year 2019 but far from reaching its full potential.

According to the International Monetary Fund, India’s economy grew by about 4.8% in 2019, a sharp drop from 6.8% in 2018. Similarly, unemployment rose to 7.5% in the last 3 months of 2019.

There is an urgent need to approach the challenge of liquidity suffered by the sector, especially after the NBFC cash crisis. Liquidity will improve sentiment in the market with a regular supply of ready to move-in homes. If the challenge is not tackled on priority, it will block the confidence of developers as well as buyers which may seriously affect the realty sector as well as the economic growth of the country.

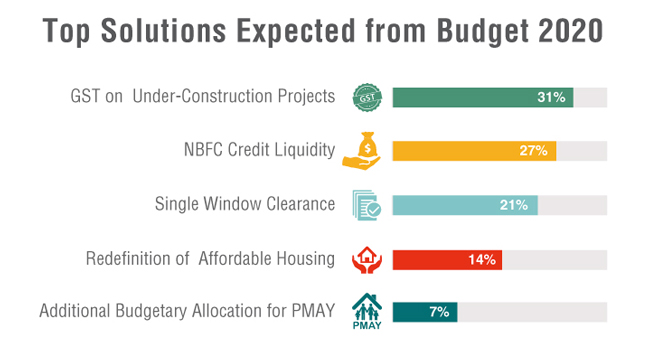

Few bold govt measures that could revive the real estate market in the year to come including tax rebate hike, personal tax relief, higher liquidity, better land reforms and fast infrastructure development for raising homebuyer sentiments.

The industry body has also suggested the government to reconcile the Insolvency and Bankruptcy Code (IBC), GST and individual taxes to help increase demand for unsold properties, which increased sharply in 2019.

The reviving real estate sector would also improve overall demand as the sector employs a large number of laborers belonging to lower-income groups. As a result, it could lead to a strong rise in rural demand.

However, it needs to be noted that the measures are not yet sufficient in size and will not be able to cater to real estate developers (small and big) and players in Tier 2 and 3 cities. Most importantly, the measures need to be backed by other factors mentioned below to bring in a proper resolution. Instant step in terms of implementation of several schemes and processes is expected to bring momentum into the sector in 2020.

Budget 2020-21 Fails to Address Major Concerns of Realty SectorFreal estate

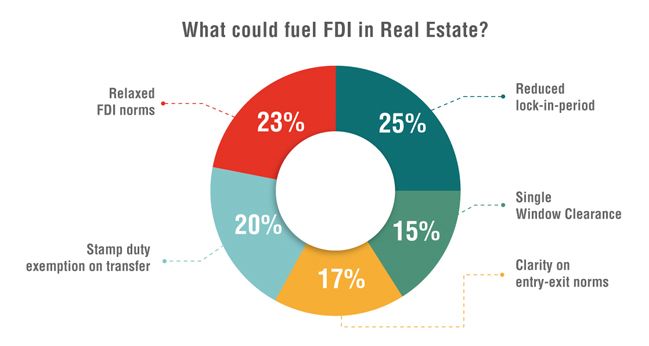

It offers a few solutions to revive the nation’s weak economy. The government’s $428 billion budget for 2020-21 considered a series of modest initiatives, including planned investments in new roads and airports and personal income tax cuts, along with an increase in bank deposit insurance to encourage customers worried by high-profile bank failures.

But it offered no large incentive plan to produce more jobs or money in the pockets of India’s 1.3 billion residents, most of whom rarely get their food through farming or work in the informal economy. Nor did the budget offer any additional support for the country’s weak financial institutions.

Few Govt measures that may put real estate back on track in 2020 includes:

Industry Status

For a long time, the real estate market demands an industry status that can help it with finances at a lower cost, especially at times when the availability of funding is a major barrier for the industry.

Single-window clearance

The sector, which is struggling to deal with multiple government offices for project approval, wants a single-window clearance facility to initiate the project implementation faster.

Removal of Multiple Rates or Taxes

Multiple rates or taxes need to be removed into a single standard GST rate.

Incorporation of Stamp Duty under GST

The cancellation of stamp duty or its incorporation under GST.

Lowering Interest Rates

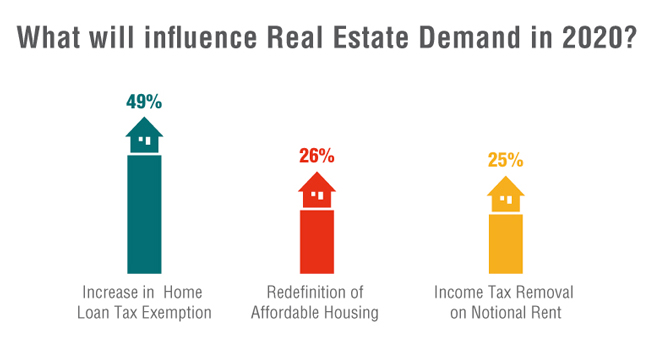

In 2019, the Reserve Bank of India (RBI) reduced the policy rates (Repo Rate) by 135 basis points. But the registered commercial banks didn’t follow the procedure. So the average marginal cost of lending rate (MCLR) of banks has decreased by only 64 bps. The lower interest rates will benefit to decide the existing liquidity crisis and boost housing demand.

Rebate in Income Tax

Rebate in individual income tax will be another help to the sector as it will decrease the financial burden of the buyers and improve their expendable income.

Housing Loan Interest Rates to be Reduced

Interest rates on housing loans also need to be reduced to encourage demand and sales. Restoration of income tax gains on a 2nd home can benefit homebuyers in a big way.

Notional Rental Income

We expect the government to release organizations involved in real estate business from the burden of tax on notional rental income or the period of 1 year should be extended to 5 years. This is pushing buyers away from the market and affecting the sector as well.

Restriction on Home Loan Interest Paid

The govt should also remove the restriction of an additional deduction of Rs 1.5 lakh paid on a home loan up to Rs 35 lakhs with total values not exceeding Rs 45 lakhs.

The government should implement land reforms and amend the acquisition process.

People’s Expectations:

It is expected that the real estate sector will hopefully observe a growth story in 2020. Covering 1,600 projects with 458,000 housing units under the center’s announcement will help in raising buyer confidence and is expected to generate significant employment. We expect the govt to give full support to the sector not just in terms of the announcement but also implementation. The year 2020 needs a device to protect developers from the existing liabilities and stuck projects. It also needs to incentivize stressed projects in various ways.

At the same time, the central government has projected that the economic growth would rebound to as much as 6.5% for the current fiscal year.