Everything You Need To Know About The Guidance Value In Bangalore

Guidance Value Of Property In Bangalore And Its Calculation:

Guidance Value is the minimum value below which no property transaction can be accomplished. It is the least value at which you can register a property. The Guidance Values are published by the Dept. of Stamps & Registration in every state and it gives the value based on locality and individual buildings/project names. Any changes in Guidance Value may increase or decrease property prices. It is a major source of generating revenue for the state. Property registrations can not go below that fixed price. A well-developed locality will have a higher Guidance Value while a least developed or under-developed locality has a lower Guidance Value.

The Stamp and Registration department performs an account of the Guidance Value in states. It is also known as Ready Reckoner Rate or Circle Rate in other states. Guidance Value is applicable to both plots and constructed properties. For plots in Bangalore, the Guidance Value is calculated on the grounds of the available land area excluding any constructed property while the value charged for the constructed properties including the land is known as a composite value.

As per the law, even if you buy a property at a lower price than the Guidance Value, you will still have to register the property at Guidance Value. If the sale value of a property is higher than Guidance Value then the property has to be registered at sale value.

The government always makes a plan to keep Guidance Value as close to market value as possible. This is prepared to control cash transactions which create black money and also to boost revenue for the state government.

However, it should be noted that Guidance Value is only the minimum price for registration and not the price at which the property would be sold. The market value of a property like other goods is changed and determined on the basis of a number of factors such as market forces, the proximity of the property to the different new developments being made in the city. For example, a property located near an upcoming airport will rise in property value.

How to calculate Guidance Value in Bangalore?

Steps To Calculate Online Guidance Value In Karnataka:

- Visit KAVERI website

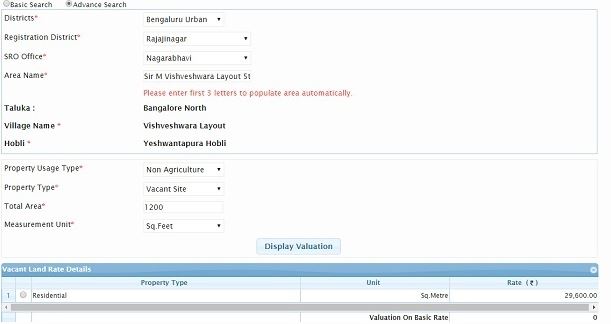

- On the webpage, you will get two search options – Basic Search and Advanced Search

- Now, you have to select ‘District’ from the drop-down menu provided

- Enter three characters in the ‘Area Name’, and the system would suggest results matching your inputs. Select your Area.

- With this, you will get more options to choose from – Property Usage Type, Total Area, and Measurement Unit.

- In the Advanced Search mode, you will need to furnish extra details such as Registration District and SRO Office.

Below image will clear your points:

Latest Updates On Guidance Value In Bangalore:

In January 2019, the Karnataka Government has increased the Guidance Value of agriculture by 5% to 25% across Karnataka. It is certainly a welcome move and farmers have a reason to cheer. But at the same time, it is expected to hurt middle-class families who are looking to buy Budget Homes in Bangalore. The new Guidance Value in Bangalore revised after a gap of 2-years that came into effect from 1st January 2019.

The last time the guidance value had been increased was in March 2017. As per the Stamps and Registration Act, the guidance value has to be revised every year. But, due to several reasons, such as the demonetization and Assembly elections, the guidance value could not be revised. The state audit team reported that there is a huge gap between the guidance value and market rates.

To overcome the gap between Guidance Value and Market Value, the state government reviews the Guidance Value annually. The change in values helps the government to make higher revenue through stamp duty and registration fees. Reducing the gap between the Guidance Value and the Market Value also helps to control black money inflow in the real estate market.

Under the revised rates, the Guidance Value for agriculture land in Hunasemaranahalli on KIA Road in North Bangalore has hiked to a record Rs 6.5 crore/acre which is highest in the state so far. Similarly, the new Guidance Value has risen to Rs 1.8 crore per acre in some parts of Mysuru Rural Taluk, Rs 1.2 crore in parts of Bidadi Taluk in Ramanagara District, and up to Rs 80 lakh in the Hosabettu area in Dakshina Kannada.

The move is meaningful considering a person buying land will have to pay a minimum of 5.6% of Guidance Value as stamp duty.

In Bangalore (Urban), there are 42 Sub-Registrar Offices for estimating and regulating Guidance Value. For rural areas, the State government has set up five Sub-Registrar Offices.

List of Sub-Registrar Offices in Bangalore (Urban)

|

Rajajinagar District |

Basavanagudi District |

Shivajinagar District |

Gandhinagar District |

Jayanagar District |

|

Rajajinagar |

Basavanagudi |

Shivajinagar |

Gandhinagar |

Jayanagar |

|

Yashwanthpaura |

Chamarajapete |

Indiranagar |

Malleshwaram |

Santhinagar |

|

Vijayanagar |

Banashankari |

Halsuru |

Ganganagar |

BTM Layout |

|

Srirampuram |

Anekal |

Banasawadi |

Hebbal |

Kengeri |

|

Peenya |

Attibele |

KR Puram |

Kacharakanahalli |

Rajarajeshwari Nagar |

|

Laggere |

Sarjapura |

Mahadevapura |

Byatarayanapura |

JP Nagar |

|

Nagarbhavi |

Jigani |

Bidarahalli |

Yelahanka |

Bommanahalli |

|

Madanayakanahalli |

Varthur |

Jala |

Begur |

|

|

Dasanapura |

Hesaraghatta |

Tavarekere |

List of Sub-Registrar Offices in Bangalore (Rural):

- Nelamangala

- Doddaballapura

- Devanahalli

- Hoskote

As per the revised Guidance Value, property prices along the sides of the road and park facing will see a maximum hike in property prices. Below is the Guidance Value for different areas of Bangalore.

|

New Guidance Value In Bangalore |

|

|

Area |

Rates (per sq.mt) |

|

Vani Vilas Market to D. Banumalah Circle on Sayyaji Rao Road |

Rs 32,000 |

|

Banumalah Circle to K.R. Circle |

Rs 68,200 |

|

K.R. Circle to Ayurveda Hospital Circle |

Rs 1.15 lakh |

|

Ayurveda Hospital to RMC Circle |

Rs 49,100 |

|

RMC Circle to Highway Circle |

Rs 32,600 |

|

Kumbarakoppal Main Road |

Rs.1,29,000 |

|

Kumbarakoppal Cross Roads |

Rs 9,600 |

|

Kumbarakoppal Inner Cross Roads |

Rs 9,900 |

|

Kumbarakoppal Colony |

Rs 6,500 |

|

Kumbarakoppal South Side |

Rs 13,000 |

|

Gokulam Main Road |

Rs 38,400 |

|

Gokulam Cross Road |

Rs 19,800 |

|

Gokulam Ist & 2nd Stage |

Rs 25,000 |

|

Gokulam 3rd Stage |

Rs 28,000 |

|

Gokulam 4th Stage |

Rs 20,000 |

|

Contour Road EWS |

Rs 19,700 |

|

Karnataka Slum Development Board Houses |

Rs 8,600 |

|

Bogadi 1st & 2nd Stage |

Rs 28,000 |

|

Janatanagar |

Rs 11,800 |

|

Srirampura 1st Stage |

Rs 23,000 |

|

Srirampura 2nd Stage |

Rs 24,000 |

|

Metagalli Main Road |

Rs 18,300 |

|

Hale Ooru |

Rs 8,500 |

|

Ambedkar Colony |

Rs 3,500 |

|

B.M Sri Nagar Main Road |

Rs 10,100 |

|

B.M Sri Nagar Cross Road |

Rs 8,300 |

|

Karakushalanagar |

Rs 5,400 |

New Guidance Value for Agricultural Land (Per Acre) |

|

|

Agriculture land (Kushki) at Ajjayyanahundi |

Rs 51 lakh/acre |

|

Thari land at Ajjayyanahundi |

Rs 53 lakh/acre |

|

House sites at Ajjayyanahundi |

Rs 4,750/sq.mt |

|

House sites approved by the Development Authority |

Rs 10,900/sq.mt |

|

Agricultural land (Kushki) at Chowdahalli |

Rs 30 lakh/per acre |

|

Agricultural land at Ayarahalli |

Rs 8.5 lakh/acre |

|

Thari land at Ayarahalli |

Rs 9 lakh/acre |

|

Govt Uthanahalli (MUDA limits) |

Rs 32 lakh/acre |

|

Inam Uthanahalli |

Rs 8 lakh/acre |

|

Amchawadi Village in Yelwal Hobli |

Rs 3.50 lakh/acre |

|

Anandur |

Rs 20 lakh/acre |

|

Yelwal Hobli MUDA limits, Mysuru-Hunsur Road |

Rs 35 lakh/acre |

|

Anaganahalli under Mysuru West Office limits |

Rs 8 lakh/acre |

|

Arasinakere |

Rs 5 lakh/acre |

|

Udbur (MUDA Limits) |

Rs 22 lakh/acre |

|

Kadakola |

Rs 35 lakh/acre |

New Guidance Value in Major Roads of Bangalore (per sq.mt) |

|

|

Cunningham Road (Chandrika Hotel to Balekundri Circle) |

Rs 2,78,600 |

|

Lavelle Road |

Rs 2,07,900 |

|

M.G.Road, Brigade Road, Residency Road |

Rs 1,95,500 |

|

12th Main, HAL 2nd Stage |

Rs 1,11,800 |

|

Defense Colony, Indiranagar |

Rs 1,71,800 |

|

CMH Road, 1st to 12th Cross |

Rs 1,43,200 |

|

9th Main, Jayanagar |

Rs 3,87,500 |

|

Dollars Colony, RMV 2nd Stage |

Rs 1,84,000 |

|

Sampige Road, Malleshwaram |

Rs 2,05,000 |

|

Sadashivanagar (C.V. Raman Avenue to Bhashyam Circle) |

Rs 2,58,200 |

|

Sankey Tank Road |

Rs 2,70,000 |

|

Dr. Rajkumar Road |

Rs 1,61,500 |

|

ESI Hospital Road, Rajajinagar |

Rs 1,10,000 |

|

Nandidurga Road |

Rs 1,75,000 |

|

Bannerghatta Main Road (Hosur Road to Dairy Circle) |

Rs 1,53,000 |

|

Vittal Mallya Road |

Rs 2,08,900 |

The FAQ On Guidance Value:

Should we register our property at Guidance Value or Market Value? And how will Guidance Value affect the property prices?

For example, if the market value of a property in a particular area is Rs.6000/sq.ft. and the Guidance Value is fixed at Rs.4500/sq.ft. by the Revenue Department, then the homebuyers have a choice to register the property at a rate anywhere between Rs.4500/sq.ft and Rs.6000/sq.ft.

But, in case, if a property offers the market rate of Rs.5500/sq.ft and the Guidance Value is priced at Rs.8000/sq.ft, then a homebuyer can not register the property below Rs 8000/sq.ft.

So, the property can be registered at either the Guidance Value or Market Value whichever is lower. But, in case of registration on the market value, you will always have to pay higher stamp duty.

How can we get the latest Guidance Value of a property?

The latest Guidance Value of the property in a particular area in a city could be obtained from the Sub-register office.

How reduced Guidance Value impact both buyers and sellers?

Taking the current market condition, where the market value of a property is much lesser than the Guidance Value, even a small reduction in Guidance Value helps both buyers and sellers in a big way. Here are some important benefits of reduced Guidance Value:

- It lowers capital gain tax for the seller

- It also lowers stamp duty and registration charges for the buyer

- It makes possible lower sale values for the buyer

Why did Guidance Value in Bangalore reduce? And how did it affect buyers, sellers, and the government?

There was a significant variation between market value and the Guidance Value. This means that very few buyers were willing to take the burden of additional stamp duty and registration charges. As a result, there were fewer transactions and hence loss of revenue for the government.

- It lowers capital gain tax for the seller

- It also lowers stamp duty and registration charges for the buyer

- It increases revenue for the government

- It makes possible lower sale values for the buyer

How the Guidance Value of a property fluctuates?

The guidance value fluctuates between localities as well as apartments or projects within the same locality. Here are a few steps that calculate the guidance value of a property for estimating your investment costs:

Prime Locality:

The current real estate trend and reputation of the developers, and the kind of upcoming projects ranging from affordable, mid-segment or luxury residences set guidance value. A locality that is recommended for luxury apartments and villas by famous builders will have a high guidance value.

Higher Floors:

The base guidance value remains the same until the 5th floor. The value rises from the 6th floor upwards.

No of Amenities:

In Bangaluru, the state government has set the lifestyle amenities given by residential properties into 14 categories varying from the clubhouse, kid’s play area, swimming pool, commercial spaces and more. The Guidance Value hike for 5 or more groups of amenity.

How to calculate the Guidance Value of property in Bangalore?

The Stamps and Registration Department of Karnataka has launched an online platform known as “KAVERI” where one can calculate the Guidance Value in Bangalore 2019.

What is the Guidance Value of commercial properties in Bangalore?

The Stamp & Registration Department has notified an increase of 50% in Guidance Value of Commercial Properties in the 11th Main, Jayanagar, 4th Block.

What is the Guidance Value of road facing properties in Bangalore?

The Stamp & Registration Department of Karnataka has revised the guidelines and mandated the Guidance Value of properties facing roads by 25%.

What is the Guidance Value of a park facing properties?

The new guidelines have imposed an additional 10% rise in Guidance Value for properties facing parks.

Why does the government raise the Guidance Value of a property?

The Guidance Value of a property is a major source of generating revenue for the state. By raising the Guidance Value, the govt expects higher revenue.

How does a hike in Guidance Value impact property prices and buyers?

After a hike of up to 25%, property rates in some parts of Bengaluru has increased significantly. Property markets of Bengaluru which is already counted among the most expensive ones in India. People find it the most expensive and holding their buying decision.

For example, the current property rate in Jayanagar is Rs 1,75,000/sq.mt based on Guidance Value. It is to be noted that a square meter is equal to 10.76 sq.ft. So, if you have 100 sq.mt (1,076 sq.ft) house in Jayanagar, the Guidance Value is Rs 17.50 lakh as per existing value. So, the recent hike in Guidance Value in Bengaluru means a significant increase in property cost.

Homebuyers will lose interest in buying property paying more as Stamp Duty and Registration Charges for areas where the Guidance Value is higher than the Market Value.

Suppose, you are buying a property of Rs 1 crore based on Guidance Value and the stamp duty is charged at 5.6%, your total stamp duty comes to Rs 5.60 lakh.

Data & Image Sources: Google